Purpose

The purpose of the Gift Acceptance Policy is to give guidance and counsel to The Westport Library (“the Library”) regarding the planning, promotion, solicitation, receipt, acceptance, management, reporting, use, and disposition of private sector gifts.

The merits of a particular gift shall be considered by the appropriate staff and/or committee of the Board of Trustees (the “Board”) along with legal counsel and the entire Board if necessary.

All fundraising activities and their day-to-day implementation are designed and managed by the Development Director and appropriate staff, and are supervised by the Executive Director.

The acceptance by the Library of a donation from any donor does not signify Library support or acceptance of that donor's personal views, nor does it grant the donor any rights or influence with respect to the Library’s collection, programming, or other operations.

The Board, through the Development and Finance Committees and the Executive Director, is responsible for implementing the Gift Acceptance Policy. This policy shall be reviewed by the Governance and Nominating Committee on a periodic basis or as circumstances warrant.

Any exceptions to this Gift Acceptance Policy may be made only in exceptional circumstances, on an individual basis, and shall require the approval of the Board.

Policy Statements

I. Receipt of Gifts

Unrestricted Gifts

Unrestricted gifts of $50,000 or less, the purpose of which is not specified by the donor, shall be allocated to the annual fund. Allocation of unrestricted gifts above that amount will be directed by the Board, upon recommendation of the Finance Committee.

Restricted Gifts

Donors can restrict gifts specifically for the Library’s annual appeal, which supports programs and services, for the Library’s general endowment, or to benefit the Library's capital projects.

If a donor wishes to designate the funds for something specific within the above-mentioned categories, the donor must communicate with the Library in writing to ensure that such designation is consistent with the Library’s mission and strategic plan

Restricted gifts of more than $50,000 must be approved by the Board.

If the donor’s specific designation at some point becomes impracticable to continue or becomes inconsistent with the mission or strategic plan of the Library, the Library reserves the right to re-allocate those funds in a manner that is consistent with the Library’s mission and strategic plan.

Noncash Gifts

While most donors to the Library use cash, checks or credit cards, noncash gifts may be considered only when it is reasonably expected they can be converted into cash within a reasonable period of time, or when the Library will utilize that gift in its operations, or chooses to add the gift to its collection, and the gift is consistent with its mission and goals.

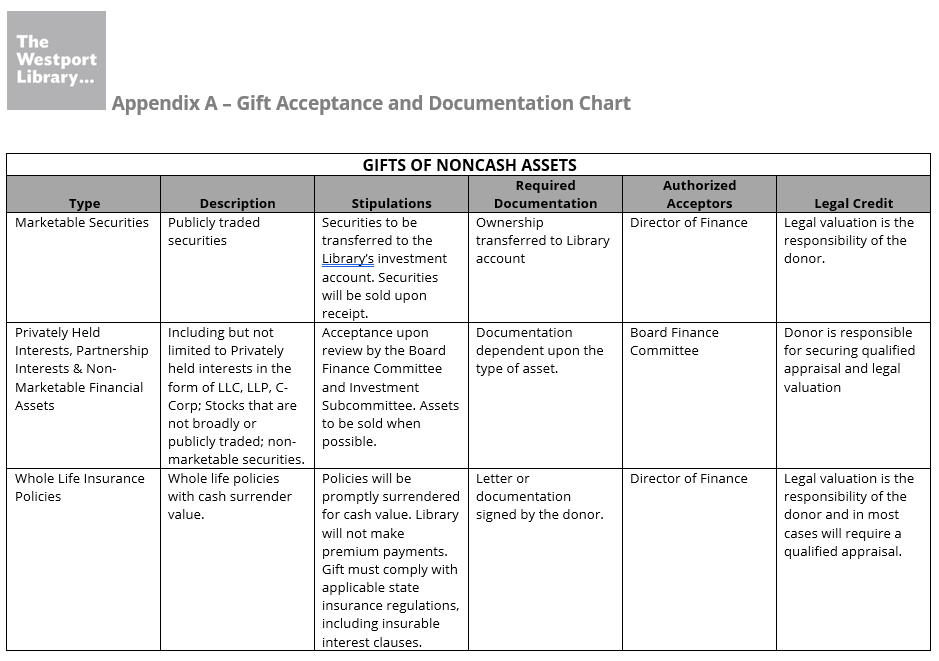

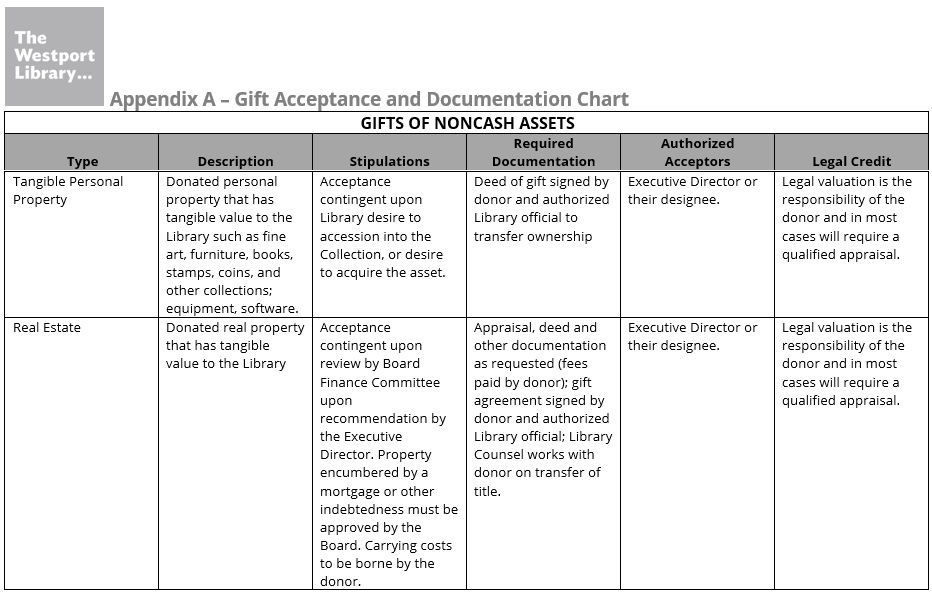

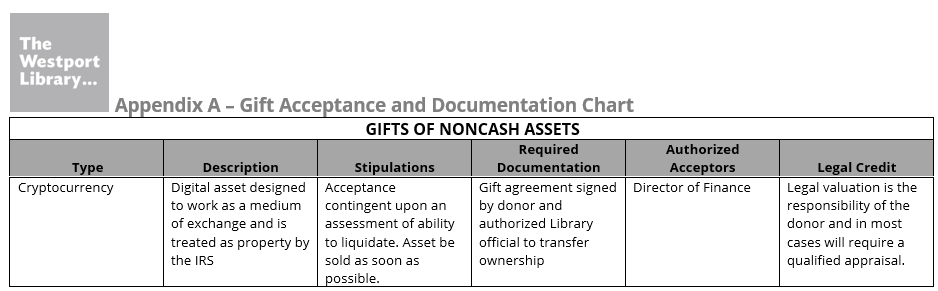

The Gift Acceptance and Documentation Chart incorporated as Appendix A summarizes the specifics for a variety of noncash gifts. The Gift Acceptance and Documentation Chart may be revised as needed by the Board Finance Committee, without requiring a review of this Gift Acceptance Policy.

Associated expenses of a noncash gift made to the Library including any attorney’s or advisor’s fees associated with this gift, or carrying costs of any encumbered donation, are to be borne by the donor.

The Library retains the right, at its own expense, to obtain its own qualified appraisals of real property or tangible or intangible personal property being offered as a gift.

The Library will acknowledge receipt of gifts of tangible personal or real property in accordance with the federal tax law and will sign any IRS form or other documents necessary for the donor to obtain a tax deduction for such gifts, so long as such acknowledgment does not entail valuing the gift.

To avoid conflicts of interest, the unauthorized practice of law, the rendering of investment advice, or the dissemination of income or estate tax advice, all donors of noncash gifts must acknowledge that the Library is not acting as a professional advisor, rendering opinions on the gift. All information concerning gift planning from the Library is to be for illustrative purposes only and is not to be relied upon in individual circumstances. The Library may require a letter of understanding from a donor of a property gift, along with proof of outside advice being rendered to the donor, before such a gift will be accepted.

The Library encourages donors to seek their own counsel in matters relating to their bequests, life income gifts, tax planning, and estate planning.

II. Unacceptable Gifts

The Library reserves the right to refuse any gift that is not consistent with its mission and goals. In addition to and without limiting the generality of, the following gifts will not be accepted by the Library:

1. Gifts that violate any federal, state, or local statute or ordinance

2. Gifts that contain unreasonable conditions (e.g., a lien or other encumbrance) or gifts of partial interest in property

3. Gifts that are financially unsound, according to the sole discretion of the Library

4. Gifts that could expose the Library to legal liability, according to the discretion of the Library

III. Ethics

The Library shall ensure that all philanthropic promotions and solicitation are ethical and that no Board members or Library personnel benefit personally from gifts received.

Conflict of Interest

The Library will ensure that individuals who engage in the solicitation of gifts on behalf of the Library are circumspect in all dealings with donors in order to avoid even the appearance of any act of self-dealing, and shall not personally benefit by way of commission, contract fees, salary, or other benefits from any donor in the performance of their duties on behalf of the Library. For purposes of this paragraph, the term “individuals” includes employees and trustees of the Library and their immediate family members, as well as any associations, partnerships, corporations, or other enterprises in which such staff members and trustees hold a material ownership interest.

Commissions for gifts

The Library will not pay commissions or finder’s fees as consideration for directing a gift to the Library. This includes and is not limited to work with fundraising consultants, financial advisors and real estate agents.

IV. Professional Counsel

Legal Counsel

On occasion the Library may retain legal counsel to review legal documents, contracts, and other donor agreements. All agreements shall follow the formats of the specimen agreements to be approved by legal counsel unless counsel has agreed in writing to a change for a specific agreement. Prospective donors shall be responsible for their own legal, accounting, appraisal, transportation, and other fees related to the Library.

V. Stewardship

The Library will be responsible for good stewardship toward its donors by following these guidelines:

1. Upon acceptance of any gift, the Library will endeavor to uphold all donor intentions expressed in writing at the time of the donation.

2. All gifts will be acknowledged within the required, or otherwise reasonable, period of time.

3. Files, records, and mailing lists regarding all donors and donor prospects are maintained and controlled by the Library. Donor information is confidential and is strictly for the use of the Library Board and staff and will be maintained in accordance with the Library’s Privacy Policy.

4. Gifts to the Library and accompanying correspondence will be considered confidential information, with the exception of the publication of donor recognition activities. All donor requests for confidentiality will be honored.

5. Names and personal details of donors will not be provided by the Library to other organizations, nor will any lists be sold or given to other organizations.

VI. Conformity to Federal and State Regulations

Adherence to the Law

The Board will ensure that fundraising activities comply with local, state and federal laws, including but not limited to laws and regulations governing 501(c)(3) organizations.

Revised and adopted by the Board of Trustees on November 30, 2022.